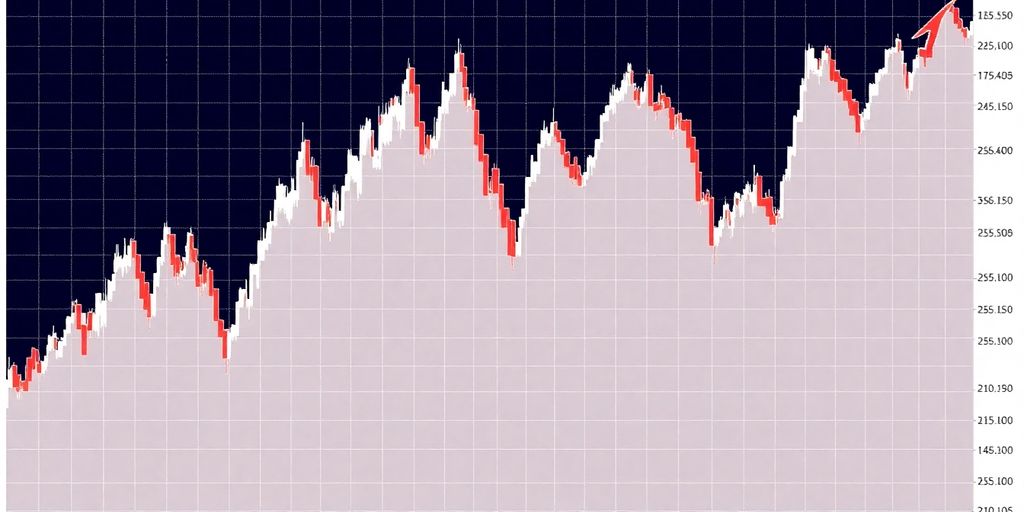

Aya Gold & Silver Inc. has announced a significant financial move, entering into a bought deal agreement to offer 7,491,000 common shares at $13.35 per share, aiming to raise over $100 million. This strategic offering, led by Desjardins Capital Markets, is intended to fuel the company's exploration programs and bolster its working capital.

Aya Gold & Silver Secures $100 Million Investment for Growth

Aya Gold & Silver Inc. (TSX: AYA; OTCQX: AYASF) has finalized an agreement for a bought deal offering of common shares, projecting gross proceeds of $100,004,850. The offering involves the sale of 7,491,000 common shares at an issue price of $13.35 per share. Desjardins Capital Markets is serving as the sole bookrunner, supported by a syndicate of underwriters including National Bank Financial Inc. and BMO Capital Markets.

Key Details of the Offering

- Shares Offered: 7,491,000 common shares

- Issue Price: $13.35 per share

- Gross Proceeds: $100,004,850

- Lead Underwriters: Desjardins Capital Markets (sole bookrunner), National Bank Financial Inc., BMO Capital Markets

- Over-Allotment Option: Underwriters have a 30-day option to purchase an additional 15% of the shares, which could raise an extra $15,000,728, bringing the total potential proceeds to approximately $115,005,578.

Strategic Use of Proceeds

The net proceeds from this offering are earmarked for critical business objectives, primarily focusing on advancing Aya Gold & Silver's exploration initiatives and strengthening its financial liquidity. The planned uses include:

- Advancement of the exploration program at Boumadine.

- Furthering the exploration program at Zgounder Regional.

- General working capital and corporate purposes.

Timeline and Regulatory Approvals

The closing of the offering is anticipated to occur on or about June 19, 2025. This is contingent upon fulfilling various conditions, including securing all necessary approvals from regulatory bodies such as the Toronto Stock Exchange and applicable securities regulatory authorities. The offering will be conducted via a prospectus supplement to the company's short form base shelf prospectus, which is expected to be filed by June 12, 2025.

About Aya Gold & Silver Inc.

Aya Gold & Silver Inc. is a rapidly expanding, Canada-based silver producer with significant operations located in the Kingdom of Morocco. As the sole TSX-listed pure silver mining company, Aya operates the high-grade Zgounder Silver Mine and is actively exploring properties along the prospective South-Atlas Fault. The company's management is committed to maximizing shareholder value through sustainable operations, robust governance, and strategic financial growth.

Sources