Tariffs and Economic Fears Drive U.S. Stocks Lower

U.S. stocks decline amid economic fears and tariff uncertainty, impacting inflation and investor sentiment. Key takeaways on market volatility and economic outlook.

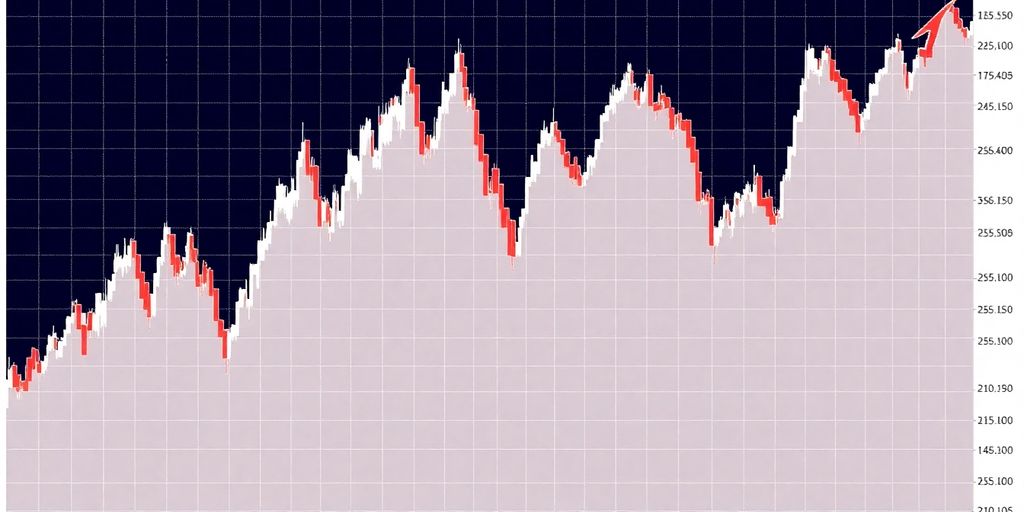

Canada's main stock index, the S&P/TSX composite, surged to a seven-week high on January 29, 2025, buoyed by a positive message from the Federal Reserve regarding U.S. economic activity. The Bank of Canada also made headlines by cutting interest rates to support the domestic economy amid concerns over potential U.S. trade tariffs.

The S&P/TSX composite index ended the day at 25,473.30, reflecting a 0.2% increase. This closing level is the highest the index has seen since December 11, 2024. The positive sentiment in the market was largely attributed to the Federal Reserve's assessment of the U.S. economy, which remains robust despite inflationary pressures.

The Federal Reserve's decision to hold interest rates steady was a key factor in the TSX's rise. The Fed's language suggested a degree of optimism about economic growth, which has led to a sense of "reflationary buoyancy" in the market. Sid Mokhtari, chief market technician for CIBC Capital Markets, noted that this could lead to a steepening yield curve in both the U.S. and Canada, benefiting financial and cyclical stocks.

In a strategic move to bolster the economy, the Bank of Canada cut its key policy rate by 25 basis points to 3%. This decision comes amid concerns that a potential tariff war with the U.S. could have detrimental effects on the Canadian economy. Colin Cieszynski, chief market strategist at SIA Wealth Management, emphasized the Bank's efforts to support the economy during these challenging times.

The combination of a positive outlook from the Federal Reserve and proactive measures by the Bank of Canada has created a favorable environment for the TSX. Investors are optimistic about the performance of cyclical stocks, particularly in the energy and materials sectors, as the market continues to respond to economic signals from both sides of the border.

U.S. stocks decline amid economic fears and tariff uncertainty, impacting inflation and investor sentiment. Key takeaways on market volatility and economic outlook.

US stocks experienced significant volatility this week due to ongoing economic concerns, including inflation, and the evolving policy landscape under the Trump administration.

Explore how Donald Trump's proposed tariff policies are driving market volatility, impacting inflation, and influencing the Federal Reserve's outlook, creating a complex environment for investors.

We're just a bunch of guys mixing up market news with our own brand of banter, giving you the lowdown on stocks with a twist at Walk The Street Capital.