Tariffs and Economic Fears Drive U.S. Stocks Lower

U.S. stocks decline amid economic fears and tariff uncertainty, impacting inflation and investor sentiment. Key takeaways on market volatility and economic outlook.

European shares experienced a notable recovery on January 28, 2025, closing at a record high as the recent tech selloff began to ease. The pan-European STOXX 600 index rose by 0.4%, driven primarily by gains in the retail sector, which saw a 2.1% increase. This rebound came a day after a significant market downturn triggered by concerns over a low-cost AI model from the Chinese startup DeepSeek, which had rattled investors globally.

The retail sector was the standout performer in the European markets, with several companies posting impressive gains. Notable performers included:

This surge in retail stocks reflects a broader recovery sentiment among investors, who are regaining confidence after the recent tech-related selloff.

After facing significant pressure, the European technology index managed to recover slightly, increasing by 0.3%. Key highlights include:

The initial panic caused by DeepSeek's AI model has led to a cautious approach among investors, who are now reassessing the valuations of tech stocks.

Investor sentiment is currently influenced by the anticipation of interest rate decisions from major central banks. Analysts are closely watching the U.S. Federal Reserve and the European Central Bank, with expectations of a quarter-point rate cut already factored into the ECB's outlook.

Bank of America Global Research analysts suggest that the ECB may continue to cut rates, potentially reaching a terminal rate of 1.5% or lower, depending on economic data.

Several companies reported significant movements in their stock prices:

The recovery of European shares signals a potential stabilization in the market following the recent tech selloff. As investors shift their focus to upcoming economic indicators and central bank decisions, the market's direction will depend on how these factors unfold in the coming weeks. The resilience shown by the retail sector and the cautious recovery in technology stocks may set the stage for a more balanced market environment moving forward.

U.S. stocks decline amid economic fears and tariff uncertainty, impacting inflation and investor sentiment. Key takeaways on market volatility and economic outlook.

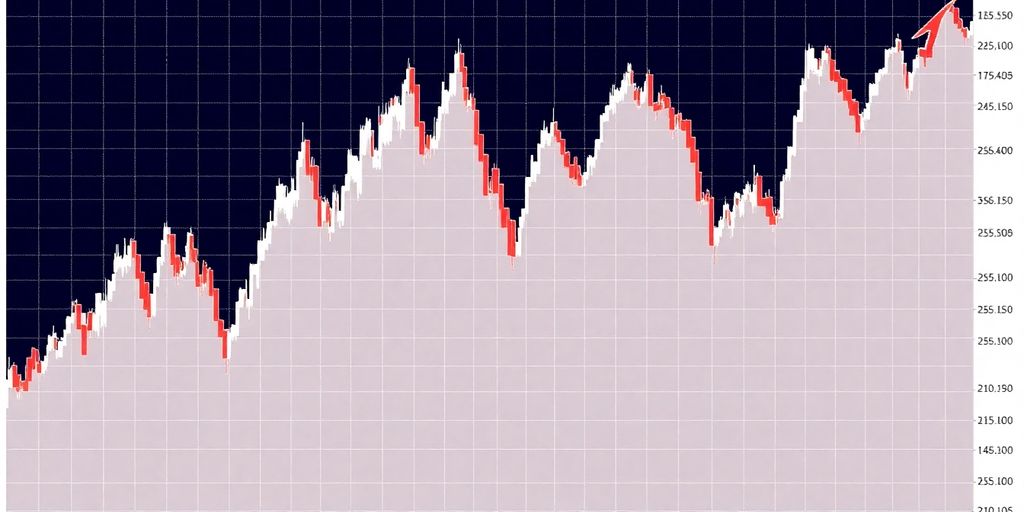

US stocks experienced significant volatility this week due to ongoing economic concerns, including inflation, and the evolving policy landscape under the Trump administration.

Explore how Donald Trump's proposed tariff policies are driving market volatility, impacting inflation, and influencing the Federal Reserve's outlook, creating a complex environment for investors.

We're just a bunch of guys mixing up market news with our own brand of banter, giving you the lowdown on stocks with a twist at Walk The Street Capital.